The approval of breakthrough innovative drugs plays a pivotal role in shaping the future of pharmaceutical companies. For instance, in 2024, Madrigal and Verona made a significant mark with the successful launches of their groundbreaking drugs, Rezdiffra and Ohtuvayre, leading to impressive performance and rapid recognition.

Looking ahead to 2025, the FDA is expected to approve a range of new drugs across various fields, including oncology, rare diseases, and chronic conditions. These innovative treatments not only promise new hope for patients but also signal the start of a new era of growth in the biopharmaceutical industry. Below is a detailed analysis of the major new drugs likely to be approved in 2025.

| Drug | Company | Indication | Est. Approavl Date | Est. 2030 sales |

| Vanza triple | Vertex Pharmaceuticals | Cystic fibrosis | Approved on Dec 20, 2024 | $8.3 billion |

| Datopotamab deruxtecan | Daiichi Sankyo/AstraZeneca | Lung and breast cancers | Approved on 17 Jan. 2025 | $5.9 billion |

| Suzetrigine | Vertex Pharmaceuticals | Acute and neuropathic pain | Approved on 30 Jan. 2025 | $2.9 billion |

| Aficamten | Cytokinetics | Hypertrophic cardiomyopathy | / | $2.8 billion |

| Brensocatib | Insmed | Neutrophil-mediated diseases | / | $2.8 billion |

| Tolebrutinib | Sanofi | Multiple sclerosis | / | $1.4 billion |

| Mazdutide | Innovent/Eli Lilly | Type 2 diabetes and obesity | / | $1.3 billion |

| Depemokimab | GSK | Severe allergic asthma | / | $1.2 billion |

| Nipocalimab | Johnson & Johnson | Myasthenia gravis and other autoimmune disorders | / | $1.2 billion |

Vertex Pharmaceuticals – Two Groundbreaking New Drugs

Vertex Pharmaceuticals is poised to emerge as a major winner in 2025. The company is set to launch two groundbreaking new drugs, with its next-generation cystic fibrosis therapy, Alyftrek (Vanza triple), expected to generate $8.3 billion in sales by 2030—well ahead of other newly approved treatments.

Vertex, which started with orphan drugs for cystic fibrosis (CF), has grown into a biotechnology powerhouse with annual revenues surpassing $10 billion. CF is an inherited disease caused by mutations in a gene called the cystic fibrosis transmembrane conductance regulator (CFTR). The CFTR gene provides instructions for the CFTR protein . Vertex has developed a series of innovative drugs, including Trikafta, Kalydeco, Orkambi, and Symdeko, establishing a dominant position in the CF treatment market.

Currently, Trikafta, the company’s third-generation CF combination therapy, is its biggest revenue source. Although it comes with a high price tag, the drug is highly effective in improving lung function and quality of life for CF patients. In 2023, Trikafta generated $8.9 billion in sales, with projections for 2024 sales to exceed $10 billion.

1. Alyftrek (Vanza triple)

- Used for: Cystic fibrosis

- Est. 2030 sales: $8.3 billion

- FDA Approval Date: Dec 20, 2024

Vanza triple (vanzacaftor/tezacaftor/deutivacaftor) snagged its FDA approval a bit early at the end of 2024, for treating CF in people aged 6 years and older with at least one F508del mutation or another responsive mutation in the CFTR gene. Alyftrek is the fifth CFTR modulator to secure FDA approval and first once-daily CFTR modulator.

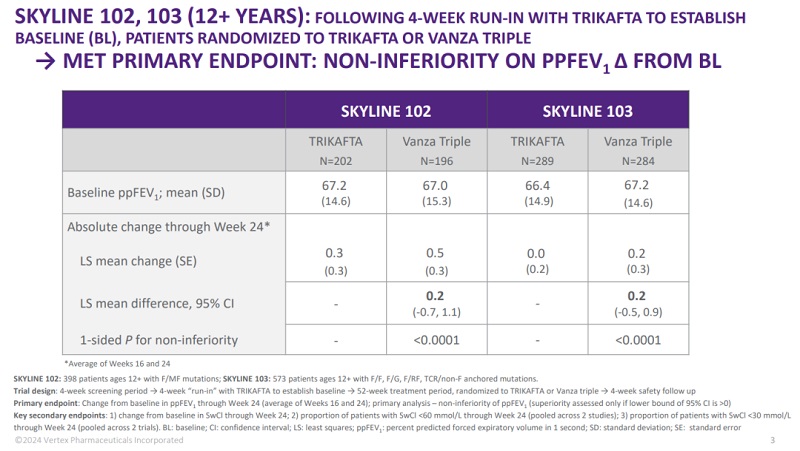

Figure 1. SKYLINE 102 and SKYLINE 103 primary end point, source: Vertex official website

Alyftrek improves upon its predecessor, Trikafta, in several key areas, offering a more convenient dosing regimen and broader eligibility. Analysts predict its sales could reach $8.3 billion by 2030, potentially surpassing Trikafta.

2. JOURNAVX™ (suzetrigine)

- Used for: Acute and neuropathic pain

- Est. 2030 sales: $2.9 billion

- FDA Approval Date: Jan 30, 2025

The FDA has approved JOURNAVX™ (suzetrigine), an oral, non-opioid, highly selective NaV1.8 pain signal inhibitor for the treatment of adults with moderate-to-severe acute pain. JOURNAVX is the first and only approved non-opioid oral pain signal inhibitor and the first new class of pain medicine approved in more than 20 years.

Novel Drug in Cancer Treatment

1. Datroway (Datopotamab Deruxtecan)

- Company: Daiichi Sankyo/AstraZeneca

- Used for: Lung and breast cancers

- Est. 2030 sales: $5.9 billion

- FDA Approval Date: Jan 17, 2025

DATROWAY is a specifically engineered TROP2 directed DXd antibody drug conjugate (ADC). On January 17, 2025, the drug was approved by the U.S. FDA for the treatment of unresectable or metastatic HR-positive, HER2-negative breast cancer in adult patients. In clinical trials, median progression-free survival (PFS) was 6.9 months in patients treated with Datroway versus 4.9 months with chemotherapy, significantly reducing the risk of disease progression or death. Additionally, the drug received FDA Priority Review designation for the treatment of adult patients with locally advanced or metastatic EGFR-mutant non-small cell lung cancer (NSCLC).

Anticipated GLP-1 Drug

1. Mazdutide

- Company: Innovent/Eli Lilly

- Used for: Type 2 diabetes and obesity

- Est. 2030 sales: $1.3 billion

Mazdutide is a glucagon-like peptide-1 receptor (GLP-1R) and glucagon receptor (GCGR) dual agonist. In clinical trials, participants treated with high doses of Mazdutide experienced significant weight loss, demonstrating strong potential for weight management. Innovent has submitted an approval application in China for Mazdutide to manage weight in adults with obesity or overweight, as well as to control blood sugar in patients with type 2 diabetes.

Other Anticipated Drug Launches Of 2025

1. Aficamten

- Company: Cytokinetics

- Used for: Hypertrophic cardiomyopathy

- Est. 2030 sales: $2.8 billion

Aficamten (CK-274) is a next-generation cardiac myosin inhibitor for the treatment of hypertrophic cardiomyopathy. Its regulatory filing is primarily based on the results of the pivotal Phase 3 SEQUOIA-HCM trial, which showed that treatment with aficamten for 24 weeks significantly improved exercise capacity compared to placebo, increasing peak oxygen uptake (pVO2) measured by cardiopulmonary exercise testing (CPET) by 1.8 ml/kg/min compared to baseline in patients treated with aficamten versus 0.0 ml/kg/min in patients treated with placebo.

2. Brensocatib

- Company: Insmed

- Used for: Neutrophil-mediated diseases

- Est. 2030 sales: $2.8 billion

Brensocatib is a small molecule, oral, reversible inhibitor of dipeptidyl peptidase 1 (DPP1) being developed by Insmed for the treatment of patients with bronchiectasis, chronic rhinosinusitis without nasal polyps, hidradenitis suppurativa, and other neutrophil-mediated diseases. The FDA has accepted the New Drug Application (NDA) for brensocatib for patients with non-cystic fibrosis bronchiectasis and granted Priority Review designation to the NDA with a target action date of August 12, 2025, under the Prescription Drug User Fee Act (PDUFA).

3. Tolebrutinib

- Company: Sanofi

- Used for: Multiple sclerosis

- Est. 2030 sales: $1.4 billion

Tolebrutinib is an investigational, oral, brain-penetrant, and bioactive Bruton’s tyrosine kinase (BTK) inhibitor that achieves cerebrospinal fluid concentrations predicted to modulate B lymphocytes and disease-associated microglia. Positive results from the HERCULES phase 3 study in people with non-relapsing secondary progressive multiple sclerosis (nrSPMS) demonstrated that tolebrutinib delayed the time to onset of 6-month confirmed disability progression (CDP) by 31% compared to placebo.

4. Depemokimab

- Company: GSK

- Used for: Severe allergic asthma

- Est. 2030 sales: $1.2 billion

Depemokimab is the first ultra-long-acting biologic to be evaluated in phase III trials with a binding affinity and high potency for interleukin-5 (IL-5), enabling six-month dosing intervals for patients with severe asthma. Clinical trial results show that depemokimab significantly reduces the asthma attack rate in patients with severe asthma and decreases the incidence of clinically significant exacerbations that require hospitalization or emergency treatment.

5. Nipocalimab

- Company: Johnson & Johnson

- Used for: Myasthenia gravis and other autoimmune disorders

- Est. 2030 sales: $1.2 billion

Nipocalimab is an investigational FcRn blocker, evaluated in a broad population of antibody positive (anti-AChR+, anti-MuSK+, anti-LRP4+) adults with generalized myasthenia gravis (gMG). Nipocalimab has demonstrated in multiple studies its ability to reduce IgG, including autoantibodies, in antibody-positive adults with gMG. The Vivacity-MG3 study further supports its potential to target the underlying cause of this autoimmune disease, with data showing up to a 75% reduction in median pre-dose total IgG.

References:

Looking ahead at the most anticipated drug launches of 2025 https://www.fiercepharma.com/pharma/looking-ahead-most-anticipated-drug-launches-2025